Retirement Series #3. Please take note that this article is looking at post retirement expenditure where assumption is no children's education and loans as expenditure. This monthly expenditure is also for 2 persons (i.e. Husband and Wife).

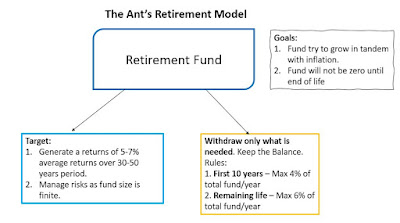

In my previous articles, we explored if you are able to retire with RM2mil and also retire with RM3mil net worth (early retirement). If you follow through those articles, you will realize that the figure mentioned in the Ant's Retirement Model is RM6,000 allowed spending per month.

In this article, we are going to explore how would a RM6,000 per month retiree lifestyle be. The assumption is it'll be used by 2 persons (considering that husband and wife retires) with no financial support from children.

The Ant's Tree and Leaves Model for Expenditure

With reference to the diagram above, to spend RM6,000/month is relatively luxurious. It will definitely not allowed you a high life or frequent holidays but it does provide you a quality of life of a typical middle class in Malaysia. When I say middle-class quality of life in Malaysia, I do mean that it's in Kuala Lumpur, Penang or even Johor where living expenditure is actually higher.

Let's dive further into how we structure the trunk and the leaves. The 'tree trunk' is the amount of money you're going to spend where the 'leaves' indicate that the money which will 'withers and drop' as you spend them.

Category of Expenditure

1. Utilities Charges (Electricity, Water, Sewerage) RM350

This is self explanatory - RM350/month for all 3 utilities is not excessive and the users will have to use the a/c sparingly. Bills can be higher when weather is hot but will save up on colder months.

2. Maintenance Fees and Property Upkeeping RM400

Condo living or landed gated and guarded will cost RM100 - RM300/month for maintenance or security fees. For landed house, there will be a cost to cut grasses, exterior cleaning/maintenance etc. There will be a need to do minor repairs regularly considering that the property the couple living in is aging.

3. Car related (Petrol, Toll, Insurance, Maintenance) RM600

Fuel, toll, car insurance and maintenance fees are not cheap. Again RM600/month is relatively low and consideration is made that the person drives a sub-RM100k car. Many people I know maintain a bigger car (i.e. Toyota Vios/Altis) for long distance travelling and a smaller one (i.e. Perodua Axia) for local groceries shopping. However, the couple can choose to have only 1 car. When needed, they can rely on e-hailing services. It's actually cheaper to utilize e-hailing services if usage of the car is less than 3 times a week and distance travelled is short.

4. Insurance RM400

Insurance (especially Medical insurance) is a must for old age. This is a hedge against any illnesses which will drain you not only physically with hospital visits but financially as well, leaving the person sick and poor. With RM400/month, you will be able to get 2 medical cards with yearly limit up to RM1mil and unlimited lifetime coverage (at 60 years old, but it will increase as you age).

5. Internet, TV, Telcos RM300

Internet, IPTV and mobile service subscription are a must these days and governments across the world is considering making them a 'utility'. A fibre with 30mbps and IPTV package will cost you RM150+ and you will also need a plan for 2 mobile phones. It will add up to be around RM300/month, easily. If you're a tech savvy person then you might want to increase your allocation (i.e. for 500mbps or 1Gbps plan)

6. Groceries RM800

Groceries are one of the single biggest items normally in a household. It contains not only food item, but others like toiletries and other consumables. While RM800 sounds a lot but trust me if you do count them, you will be amazed that a weekend shopping cart full of items can cost up to RM300 without any organic vegetables or high end wine.

7. Medical and Pharmaceutical RM300

As we age, there will be more need for medical and pharmaceutical products. This includes your high-blood pressure, cholesterol, diabetic pills as well as vitamins and supplements like glucosamine. The cost is mandatory for some unlucky ones while nil for totally healthy persons. However, RM300/month for 2 persons should cover for vitamins (B-complex, C, Zinc and Calcium) and supplement (i.e. Glucosamine) which are essential to prevent or minimize any further illnesses at later part of life.

8. Food and Beverages RM1,200

Since the consideration is that the couple is retiring in Klang Valley or any major towns in Malaysia, it's expected of them to dine out more frequently. Dining at a restaurant for breakfasts and lunches will cost quite some money. This also consider the person's need to socialize (think of the uncles at your local coffee shop) - they drink a cup of coffee, eat a plate of noodles or Pau. The breakfast will easily set you back RM8-10/day.

9. Social Events RM500

Who wants to be lonely? No one! And at this age, you're expected to be invited to your friends' children's wedding or unfortunate events like friends and relatives' funeral. It costs money too. Some join regular yoga session as well. Other pick up hobbies like guitar, piano or even some regular visits to Genting (it might not be regular for those in employment but I know lots of retiree allocate some 'small token' to go up the 'hill' to 'kill time').

10. Spares or Misc. RM850

The spares or miscellaneous can be accumulated and be used for car upgrades (say every 10 years), travels or any family emergencies. Having some spares from budget allocation is good as there are always events in life which are unforeseen.

So what do you think about the above Expenditure structure? As Expenditure is a very much a personal choice, we can never follow exactly what we set for ourselves in reality. Sometimes, it's worth spending on things that makes our day although it cost a little more than usual (call that emotional returns). Being happy is a very big component of a successful retirement. You want to be happy, free from financial burdens and of course work-related burdens (that's the main reason why we choose retirement). Hence, to have a practical budget, one can never set a very stringent one (the spares need to be there to 'cushion' all these 'want vs needs' battle).

We have seen many who tried to retire with a limited and stringent budget but sadly end up giving up on these budgeting and control. It'll ruin your entire retirement plan and many will end up relying on children for survival. The implication is of course you will need to downgrade your living standards/lifestyle very very significantly. So we hope that by setting a clear and reasonable target/budget, you will have a fruitful and fulfilled retirement. Hope that this article is able to provide you with some guidance as all of us will retire and all of us will have to manage our 'finite' retirement fund, no matter how much is in it.

Retirement Series:

#1: Can you retire with RM3mil Net Worth?

#2: How can you retire with RM2mil cash?

#3: What is your spending power with RM6,000/month

#4: Is it possible to build a Retirement Portfolio averaging 6% return per year without EPF?

We also share our updates at i3Investor via our AntOnTheStreet Blog