Exciting adventures on Technology, Lifestyle (Food, Travel, Fun, DIY) and Financials related topics

Christmas Comes Early in MidValley KL

What I observed as Committee Member, Treasurer and Chairman for a Condo in KL

Note: The experience is shared by one of our collaborators. It does not reflects the views of antonthestreet.

I own a few properties, which I have accumulated during the property market bull run days. Most of them were being rented out for tenancy and of course it invite a series of issues, which I shall not elaborate here. I of course live in one of the properties that I own and it's a strata titled condo in Kuala Lumpur area.

Background

During one of the AGM, after missing a few of them due to notifications not forth coming by management (I suspect it's due to management's strategy of trying to have less audience for easy management), I was invited to join as a committee member. And surprisingly during the first committee meeting, I was again asked to be the treasurer as I offered a few solutions and queried a few things which could be done better. I took up the offer as I sincerely hoped that I could offer a better solution and improve the place.

By the way, my main motivation was to revive the place I am living in as it's getting worse and maintenance were not up to par (things were breaking apart faster than being repaired). Naively, the subsequently year, I took up the Chairman position with the condition that I have full support from the committee members. I naively believed that I could do what is right for everyone without much of political interference but the views were quickly quashed. That is a topic for another day I suppose.

However, by putting your fingers in a strata community, especially leading the 'board of directors' or 'cabinet ministers' team as the committee member's chair, I observed a lot of similarities in human behaviours in local communities vs country's politics.

What I Observed?

1. People are naturally selfish.

Examples:

a. Water blockage happened at Block 2, Block 1's committee will ask: Oh gosh, will that happen to us here in Block 1 as well? Can management (run by Property Management company) please do something?

b. The person upstairs throw rubbish to my unit. Since I am committee I want actions taken, no matter there is any evidence or not.

c. Noise issue only happen at Block 2, it has nothing to do with Block 1. The particular person will say: This is none of my problem here, we don't have noise issue. I wonder why your block has this issue?

2. No one is concerned about what is happening behind the scene, not even the committee members.

Examples:

a. When a staff claims Overtime regularly (since it's manned up by Property Management company), no one bothers and just signed the cheques. Overtime costs were approved for years as Committee Members think it's "everyone's money".

b. When pumps are broken, pipes bursts and residents' units got affected, everyone will make noise. However, when the Property Management company does not ensure all services are being maintained properly, no one cares, not even the committee members.

3. You think that Management knows everything and will do the needful to resolve issue? NO, you're wrong! It's very scary to think about this: All owners pay maintenance fees to Management. When there are issues, the management knows what to do. In actual fact, they don't! In many incident, things were left there waiting for a major event to happen. In strata living, you must always trust your gut feel that if something is wrong and the management is not doing anything, you may lodge an official complaint to Commissioner of Building, hoping that the management will be forced to do something. However, if that does not work out and you feel endanger, move out.

Examples:

a. The likes of Highland Tower in Ampang or Puchong's landslide incident.

b. Management think that cracks between floor slab or main building and walkway is not important.

c. There are major breaches by of fire fighting equipment (i.e. Fire-rated doors, hose reels)

4. You believe that Management will make decision that benefits all residents. Nah, it is not always true and sometimes it's benefiting a certain group of people only. In my group, I was the one with the most knowledge related to property and property management. The Property Management companies that we worked with always tried to take short-cuts or find an easy way out. Since the Building Managers, Technicians take a fixed salary, they are not keen to do more to make things right.

Example:

a. Car park at common areas opened up for visitors - it's actually to suit one of the committee's frequent visiting friends.

b. Noise issues were left unattended because the persons playing there are related to the committees.

c. Rubbish bins, notices etc can be repositioned or removed because the persons complained are related to the committees.

d. Certain neighbours are allowed to park at restricted areas because they have connection to committee members.

5. Management is going to be truthful and straight-forward in sharing information - again NO! What I learn is the Management companies are a lazy bunch of companies. They want to do the minimum. When I was the Chairman, I was told by this senior manager of the company that "to manage the residents, we share minimum info. If they need anything, they can come down to the office".

Examples:

a. There are plenty of dengue cases at my areas. I have been complaining for years and asked them to do something but nothing was ever done. DBKL came and put up banners warning the residents. When I ask management office, they just tell us - they are doing regular fogging and nothing else. I asked why no sharing of info on new dengue cases and they responded by saying there isn't a need.

b. COVID19 cases - the management will not share anything not unless it's mandated by the law. It's only when they are forced to, they will share.

6. House rules are literally rubbish and Management are 'chicken' in issuing fines. Every place has their own house rules but they are always not being executed. When you press the management, they will tell you that they have spoken to your neighbours etc whenever there is a breach. In actual fact, it always never happen (unless you call the police in for noise issue etc). In almost all house rules, it's written that Management are allowed to issue compounds/fines to residents for not complying to the house rules.

Examples:

a. Clothes over the walls are never taken seriously until something happen. Management always never bothered to take actions.

b. Air conditioning outdoor unit installed at areas other than A/C ledge. This again is an eyesore and for older condo/apartments there are so many cases of this happening.

c. Throwing of rubbish and items from upstairs. A very popular issue that management didn't quite manage to resolve.

7. Lots of Bias. You can say the Americans had a lot of issues between the whites and blacks. You can safely say that it happen here as well. If the committee team is manned up by mostly one single ethnic group, they will normally hire people from the same ethnic group. When I was holding positions, I had always tell the management that we live in a multiracial country hence it's always best to have a mix, not only for racial sensitivities but also for reliefs when someone is on leave for festivity. Not only the bias in manning up personnel, there are also a lot of bias (i.e. strategic car parks, shop lots given to friends of management staff or even committee). I was once told by the Building Manager that since you're the Chairman, the guards will not clamp your car - I responded by saying that this is wrong and if I park temporarily for duties related to running the management, I can be forgiven. Else, I should be treated as any ordinary resident. While you can't escape bias in reality but I must say it's pretty serious sometimes in property management.

8. Commissioner of Buildings (in City Councils) couldn't care less. We always think that going to the Police, CoB or any local authorities help but however it doesn't do much most of the time. They receive a lot of complaints everyday and for most cases they will just park it aside and forget about it. However, lodging a formal complaint will definitely be important so that in the event of an incident (i.e. fire or landslip), the person can show proof that it's due to negligence by someone and there is a basis for further actions.

The Starbucks Buy 1 Get 1 Free Promo!

Something for the weekend and not so heavy, especially for the chilly Sunday morning.

Starbucks is one of the coffee chain here in Malaysi which managed to capture the middle-to-upper class market pretty well, as opposed to Coffee Beans. In my previous article, I mentioned that Starbucks is great with their drinks but not so much with their individual coffee (what I mean here is espresso or americano). If you're are still unable to understand what they mean, you can read it up here for a quick guide and for Sunday past time activities.

Now, back to our original topic, Starbucks is offering Buy 1 get 1 Free promo since Oct 2020 and they have extended the offer till end-Dec 2020. If you miss their drinks, do drive down to the nearest Starbucks every weekend from 10am to 12pm. However, a note of caution is there is quite a queue at a few of the starbucks that I went to. Be sure to be there early to enjoy the promo.

Some photos to 'quench your coffee thirst' for the time being.

Back to the Future anyone, with a DeLorean Time Machine?

Trapped at home and watching too much of movies and series? And I am one who actually ran out of things to watch. While doing some shopping at MPH bookstore Midvalley Megamall, I ran into something pretty interesting: The DeLorean Time Machine! Oh boy, if I could take that car and either go into the future for a COVID19 vaccine or back to time where we didn't have to mask up every time we are out in public will be fantastic.

Eaglemoss is a company which sells a lot of collectibles, including the evergreen Back To The Future Delorean time machine where a lot of us will be thrilled to assemble and 'test it out'. However, it comes at a cost, not cheap especially for those in Malaysia.

The weekly magazine has a total of 130 issues. After the car is fully assembled it will be a Dolorean DMC-12 model with a scale of 1:8. Material used is die-cast metal and ABS, with details including working interior and exterior lights, gullwing doors.

Below are the photos I took from MPH bookstore. For those who wants an entire collection, you might want to ask the importers if you can get all of them. Price is RM34.90 per copy but understand that you can get it for RM24.90 without delivery. If you're buying the whole 130 issues (to enable you to assemble the car), do negotiate for a special price or free shipping/delivery. The entire collection will easily set you back RM3300, it's a pretty expensive hobby to have. Good luck!

Retirement Series: What is your spending power with RM6,000/month?

Retirement Series #3. Please take note that this article is looking at post retirement expenditure where assumption is no children's education and loans as expenditure. This monthly expenditure is also for 2 persons (i.e. Husband and Wife).

In my previous articles, we explored if you are able to retire with RM2mil and also retire with RM3mil net worth (early retirement). If you follow through those articles, you will realize that the figure mentioned in the Ant's Retirement Model is RM6,000 allowed spending per month.

In this article, we are going to explore how would a RM6,000 per month retiree lifestyle be. The assumption is it'll be used by 2 persons (considering that husband and wife retires) with no financial support from children.

With reference to the diagram above, to spend RM6,000/month is relatively luxurious. It will definitely not allowed you a high life or frequent holidays but it does provide you a quality of life of a typical middle class in Malaysia. When I say middle-class quality of life in Malaysia, I do mean that it's in Kuala Lumpur, Penang or even Johor where living expenditure is actually higher.

Let's dive further into how we structure the trunk and the leaves. The 'tree trunk' is the amount of money you're going to spend where the 'leaves' indicate that the money which will 'withers and drop' as you spend them.

Category of Expenditure

1. Utilities Charges (Electricity, Water, Sewerage) RM350

This is self explanatory - RM350/month for all 3 utilities is not excessive and the users will have to use the a/c sparingly. Bills can be higher when weather is hot but will save up on colder months.

2. Maintenance Fees and Property Upkeeping RM400

Condo living or landed gated and guarded will cost RM100 - RM300/month for maintenance or security fees. For landed house, there will be a cost to cut grasses, exterior cleaning/maintenance etc. There will be a need to do minor repairs regularly considering that the property the couple living in is aging.

3. Car related (Petrol, Toll, Insurance, Maintenance) RM600

Fuel, toll, car insurance and maintenance fees are not cheap. Again RM600/month is relatively low and consideration is made that the person drives a sub-RM100k car. Many people I know maintain a bigger car (i.e. Toyota Vios/Altis) for long distance travelling and a smaller one (i.e. Perodua Axia) for local groceries shopping. However, the couple can choose to have only 1 car. When needed, they can rely on e-hailing services. It's actually cheaper to utilize e-hailing services if usage of the car is less than 3 times a week and distance travelled is short.

4. Insurance RM400

Insurance (especially Medical insurance) is a must for old age. This is a hedge against any illnesses which will drain you not only physically with hospital visits but financially as well, leaving the person sick and poor. With RM400/month, you will be able to get 2 medical cards with yearly limit up to RM1mil and unlimited lifetime coverage (at 60 years old, but it will increase as you age).

5. Internet, TV, Telcos RM300

Internet, IPTV and mobile service subscription are a must these days and governments across the world is considering making them a 'utility'. A fibre with 30mbps and IPTV package will cost you RM150+ and you will also need a plan for 2 mobile phones. It will add up to be around RM300/month, easily. If you're a tech savvy person then you might want to increase your allocation (i.e. for 500mbps or 1Gbps plan)

6. Groceries RM800

Groceries are one of the single biggest items normally in a household. It contains not only food item, but others like toiletries and other consumables. While RM800 sounds a lot but trust me if you do count them, you will be amazed that a weekend shopping cart full of items can cost up to RM300 without any organic vegetables or high end wine.

7. Medical and Pharmaceutical RM300

As we age, there will be more need for medical and pharmaceutical products. This includes your high-blood pressure, cholesterol, diabetic pills as well as vitamins and supplements like glucosamine. The cost is mandatory for some unlucky ones while nil for totally healthy persons. However, RM300/month for 2 persons should cover for vitamins (B-complex, C, Zinc and Calcium) and supplement (i.e. Glucosamine) which are essential to prevent or minimize any further illnesses at later part of life.

8. Food and Beverages RM1,200

Since the consideration is that the couple is retiring in Klang Valley or any major towns in Malaysia, it's expected of them to dine out more frequently. Dining at a restaurant for breakfasts and lunches will cost quite some money. This also consider the person's need to socialize (think of the uncles at your local coffee shop) - they drink a cup of coffee, eat a plate of noodles or Pau. The breakfast will easily set you back RM8-10/day.

9. Social Events RM500

Who wants to be lonely? No one! And at this age, you're expected to be invited to your friends' children's wedding or unfortunate events like friends and relatives' funeral. It costs money too. Some join regular yoga session as well. Other pick up hobbies like guitar, piano or even some regular visits to Genting (it might not be regular for those in employment but I know lots of retiree allocate some 'small token' to go up the 'hill' to 'kill time').

10. Spares or Misc. RM850

The spares or miscellaneous can be accumulated and be used for car upgrades (say every 10 years), travels or any family emergencies. Having some spares from budget allocation is good as there are always events in life which are unforeseen.

So what do you think about the above Expenditure structure? As Expenditure is a very much a personal choice, we can never follow exactly what we set for ourselves in reality. Sometimes, it's worth spending on things that makes our day although it cost a little more than usual (call that emotional returns). Being happy is a very big component of a successful retirement. You want to be happy, free from financial burdens and of course work-related burdens (that's the main reason why we choose retirement). Hence, to have a practical budget, one can never set a very stringent one (the spares need to be there to 'cushion' all these 'want vs needs' battle).

We have seen many who tried to retire with a limited and stringent budget but sadly end up giving up on these budgeting and control. It'll ruin your entire retirement plan and many will end up relying on children for survival. The implication is of course you will need to downgrade your living standards/lifestyle very very significantly. So we hope that by setting a clear and reasonable target/budget, you will have a fruitful and fulfilled retirement. Hope that this article is able to provide you with some guidance as all of us will retire and all of us will have to manage our 'finite' retirement fund, no matter how much is in it.

Retirement Series:

#1: Can you retire with RM3mil Net Worth?

#2: How can you retire with RM2mil cash?

#3: What is your spending power with RM6,000/month

#4: Is it possible to build a Retirement Portfolio averaging 6% return per year without EPF?

We also share our updates at i3Investor via our AntOnTheStreet Blog

Retirement Series: How can you retire with RM2mil cash in Malaysia?

Retirement Series #2

As part of the continuation of the retirement discussion topic, we will explore how this interesting concept will allow us to retire with just RM2mil of Cash and almost never run out of them.

The rules, objective and assumptions are as below:

1. The objective is to never run out of money for the entire lifespan of a person & spouse.

2. Assumptions:

a. The person will need not to fund the kids' education and only need for personal and spouse's expenditure.

b. The person has RM2mil in hard cash. The cash can be invested in stocks, bonds, unit trusts, properties or even back into EPF (EPF allows self-employed to keep their money there for those <60 years old).

c. The person has fully paid for car and property he or she is living in.

So, what can be done?

Have you heard of the 4% rule? The 4% rule is a relatively popular retirement spending methodology. It simple terms, you may spend not more than 4% of your total investments (in this case it's RM2mil). 4% of RM2mil will give you RM80,000/year, which is RM6,666/month. It looks pretty decent for now but imagine the value of RM6,666/month in 20 years' time (it's probably like RM2,000 where it's barely enough for one single person's day-to-day basic expenditure). Think about graduates' pay which never really increases and you'll be in the same conundrum. Again, in simpler terms, this is not adjusted for inflation.

How do we tweak the model to make it work?

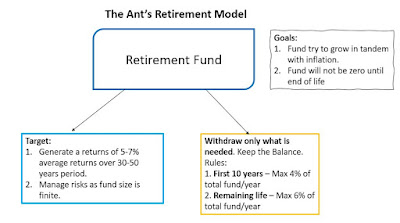

I worked on a blended model called "The Ant Retirement Model" The theory is simple, generate more than what you can spend so that you can try not to let the Retirement fund deplete.

First of all, the goals are to try to grow the fund in tandem with inflation and secondly to ensure that fund will not go into zero amount at the end of the life of the retirees.

And how do we do that?

1. Withdrawal is a very important control - for the 1st 10 years, the person is to restrict himself/herself by withdrawing <4% of the fund's value. And after that try to control withdrawal with the maximum of 6%.

2. On the returns side, set a blended portfolio which will allow an average yearly returns of between 5-7%. This has taken into consideration that Asian economies or the world economies will slow down as more countries mature.

The above diagram shows the strategy applied to generate the desired/required returns in order to fund one's retirement plan. Since the person is younger at early stage of the retirement, there will be up to 25% of the component which will be in equities to generate potentially higher returns for future use. When the person gets older, only 10% of the portfolio is being put into equities while the rest will be in Bonds, Cash funds or EPF. The reason why EPF is selected is it's a 'mixed asset fund' and it does provide the returns of 5-7% of our target above. Again, this is a hypothetical allocations which needs to be adjusted over time.

#1: Can you retire with RM3mil Net Worth?

#2: How can you retire with RM2mil cash?

#3: What is your spending power with RM6,000/month

#4: Is it possible to build a Retirement Portfolio averaging 6% return per year without EPF?

We also share our updates at i3Investor via our AntOnTheStreet Blog

Where can you invest or grow your money (legally)?

The purpose of this write up is to explore options that we all have to choose where to park our money. There are a lot of schemes (or I should call most of them scams) around us and we ought to be very careful. Below are the options that we all have and it's just an introduction of the asset classes. I will also go into the details of some and how to hunt for good deals in future articles.

1. Bank Deposit (Fixed Deposit and Savings Account). Malaysia's FD currently gives a yield of 1.5 to 2.25% these days while Savings Accounts provide a very poor 0.25 to 0.5% interests. The deposits are capital protected by PIDM up to RM250,000.00 per customer per bank.

2. Skim Simpanan Pendidikan Nasional (SSPN) is an alternative for parents with kids up to 21 years old. It offers 4% interest rate and does not restrict you from withdrawing your money. For middle to upper income group, you may also have tax deductions up to RM8,000/year. Visit their website to find out more how you can benefit.

3. Unit Trusts are 'pooled funds' that is managed by professional fund managers to grow the portfolio according to the fund's mandate. There are generally 3 types of funds:

a. Fixed Income

b. Mixed Asset/Multi Asset Funds

c. Equities fund

A lot of people have bad experiences with Unit Trust funds due to wrong selling tactic and lack of management (i.e. fund switching) by respective Unit Trust consultants. There are however a lot of successfully managed portfolios which managed to provide up to 8 or 9% returns per annum over a 10 years period.

There were some comments asking if why is Amanah Saham under the management of PNB does not show up. It is a matter of fact a form of Unit Trust investment. There are 2 types of Amanah Saham, one is fixed value (where the funds will only declare dividend) and variable value (similar to any unit trusts fund around).

4. Invest Directly in Equities (Stocks) - There are 900+ companies listed in Bursa Malaysia and many more in US (Nasdaq, NYSE) and Hong Kong Stock Exchange. By investing directly in stocks of companies, the investors will act as a passive or sleeping partner who let the professional team run the day-to-day of the companies and only go back to all the shareholders for certain mandates (i.e. AGM, EGM). Investing in stocks require investors to have some degree of knowledge in understanding accounting, business environment etc. It is however, been treated as 'casino' for some as stock prices can be volatile and speculative at times. Bottom line, to be successful in stocks investment, the person will likely need to be a seasoned or advance investor.

5. Invest in Precious Metals. There are several ways to invest in them:

a. Paper products (i.e. Paper Gold, Silver)

b. Physical (i.e. buy physical Gold and store them in a vault)

6. Buy into cryptocurrencies like Bitcoins. There are some exchanges to allow people to buy into a small proportion of the coins (i.e. 0.001) since 1 bitcoin costs USD17,000 (25/11/2020 price)!

7. Invest in Properties - This is the 2nd most popular investment vehicle in the world. Favoured by the rich as it takes a large amount of money to purchase a single property and also the fact that it can be leveraged (i.e. take a loan against the property). Properties investment is also seen as a hedge to asset price inflation (i.e. scarcity of land as population grows, increasing skilled labour costs, human urge for bigger space or certain nice and strategic location)

8. Invest in other products (i.e. Wine, Vintage Vehicles, Stamps, Antiques, Paintings, Old Coins). Investing in these products are the hardest of all. The valuation of the items often are tied to how much the buyer is willing to pay and prices can only be determined at the time of auction considering that the monetary value of it is 'how much a buyer is willing to pay'.

9. The last but not least is the most traditional way - keep your money underneath your pillows or at home. However, be warned and cautioned that this is simply the worse of all (considering no war happening)! You can easily lose your physical money and the value of your money will definitely not grow in any way.

And... don't ask me about the scams where money can earn 1% per week. Do remember this, there is no free lunch on this earth and same goes to money. Do remember the rule, if it sounds too good to be true, it's probably is. Always refer to your financially sound friends first or Bank Negara (if you're in Malaysia) or your country's financial regulators for advice prior to any suspicious investments.

Updated: 27/11.

Guardian Weekend Promo - all oral care products!

Remember to head down to Guardian or buy your oral care products from Guardian from now till Sunday. It's daily essential purchase that you can't missed.

Nando's - Double Chillies Promo!

Retirement Series: Can you retire with RM3mil Net Worth?

Retirement Series #1

Can you retire (financially)? It is a big question that most of us ask ourselves. Retiring physically and retiring with a strong financial backing are two separate things to consider. Most of us are forced into retirement either by age, illness or retrenchments but very few of us are retiring because we are financially capable of.

The context of the discussion is Are You Able to Retire with a RM3mil net worth? Again it's a big question but let's make some assumption below. Let's call this person 'Ant'

Background: Ant has a condominium with a market value of RM500k, fully paid for loans and 2 cars (market value of RM100k in total). He is 40 years old has a family with 2 growing kids age 5 and 10 years old, live a simple, decent middle-class lifestyle. Wife is working as a normal salaried worker with RM5000/month salary and plan to retire in 10 years' time. Average expenditure is RM10k/month. Assume to spend on kids until 23 years old for tertiary education and RM200k/child for tuition fees. Ant has 1 extra property which is worth RM500k, rental RM800 after deducting outgoings, loans paid off. RM800k in EPF (combined).

Quick Analysis

1. From the above, we know that Ant has RM500k + RM100k = RM600k which he is living in and using which he cannot monetize for investments.

2. Ant need to set aside RM100k for emergency funds in FD

3. Ant has an investible asset of RM3mil - RM100k (emergency fund) - RM500k (investment property) - RM600k (net worth utilized for own usage) - RM800k (EPF funds) = RM1mil

4. Relies on EPF for 4-6% annual returns and from item 3 - returns from RM1mil investments (assumption in portfolios). Rental returns is expected to be RM800/month.

Detail Analysis

*expenditure grows at 3% p.a. (inflation). In reality food inflation is a lot higher than general inflation.

*only withdraws necessary expenditure from EPF

*Cash Returns from RM1mil Portfolio assume to be 5% p.a.

*wife only works for another 10 years

*sell off RM500k investment property to fund 2 children's education in 15th years. Assume property value appreciation is sufficient to fund escalated education fees

*at 61 years old, kids grown up and financially independent. Take away RM4000/month from expenditure

*Mr Ant would like to maintain his Middle Class lifestyle (i.e. having B or C-segment cars, attending social events, active in recreational activities that will cost some money)

So, what does the above Analysis says for Mr Ant and family:

#1. His money will run out at 70 years old, leaving him with only his property and remains of his assets. To survive, he has an option to sell his house and rent it. But with the same lifestyle, it'll only last 5-8 years, sadly.

#2. Having RM1mil in investible (cash) and RM800k in EPF will typically runs out in about 30 years' time (scenario for a middle class lifestyle living in cities like Penang and KL)

#3. For Mr Ant, he will either need to take up income generating jobs for another 5 - 10 years or ask his wife to work until 55 or 60 years old. This will help stretch his retirement funds.

#4. Considering getting the kids to obtain scholarships for tertiary education to save up some money and stretch retirement.

#5. Invest in Stocks or move higher proportion of investments into higher yielding vehicles (i.e. stocks, equity funds). This definitely means higher risks, but he should be able to take it since considering his retirement is his choice, not due to medical circumstances.

#6. Insurance must be bought to prevent any financial shocks in the event of any medical emergencies and big ticket expenditures.

Alternative #3: Scenario - Wife works till 60 years old

Retirement Series:

#1: Can you retire with RM3mil Net Worth?

#2: How can you retire with RM2mil cash?

#3: What is your spending power with RM6,000/month

#4: Is it possible to build a Retirement Portfolio averaging 6% return per year without EPF?

We also share our updates at i3Investor via our AntOnTheStreet Blog

What's in your Coffee?

So you're drinking Starbucks coffee on a regular basis, or even addicted to it. But wait.. do you know that coffee is not just coffee (like most of Asians think)?

To lighten up your day, I remember my father went to Italy and he ordered a Espresso (thinking of all coffees are the same) and 1 shot of Espresso is the cheapest at 1 Euros. When he got his drink, he stared at that cup and wondered if he has ordered the wrong thing.

So, to avoid my father's mistake, I am going to show you different names of the types of coffee (that is commonly available at major coffee outlets). The common coffee that customers orders are as below. I bet you come across this at cafes, restaurants or hotels.

1. Espresso - produced via espresso machine were steamed (>10 barg pressure) were forced through the ground coffee (grinded coffee beans). Typically about 30ml only per shot.

2. Americano - Espresso diluted with hot water (layman's term it's Espresso + hot water)

3. Cappuccino - 1 part of Espresso, Steamed Milk and foam (all same proportion)

4. Latte - Espresso, Steamed Milk and thin foam

5. Mocha - Espresso, Steamed Milk, Chocolate and thin foam (aka Latte + Chocolate)

6. Macchiato - Espresso + Foam Milk

Review: Mient's Burger Port Dickson

Mient's burger is one of the local Port Dickson burger shops that attracts a fair amount of crowd, especially on weekends. Since this is my first time there hence I asked my friend who was with me to recommend.

The shop was fairly busy for a Monday and during CMCO period. Most of the customers spend ~an hour at the shop.I ordered Chic N Crisps Burger set and it came with some salads and lots of fries (pic below).

The food looked very yummy indeed.

Review:

Price : 3.5/5 stars

Taste : 4/5 stars

Portion : 5/5 stars

The portion of the food is quite big and I can't finish them alone, maybe due to the flour, fried stuff and I use to eat smaller portion of food for dinner. As for the taste, it's special and unique. Not quite the same as the burgers I used to eat. The set that I have ordered is a little bit spicy (my personal preference is for it not to be spicy). Other than that, it's value for money if you're hungry and can swallow a horse. Do drop by the shop if you're in Port Dickson - and they do FB Live from time to time.

Apple iPhone 12 - Magsafe - how they work and what you should be concerned

How it Works

MagSafe for iPhone is a bundle of component technologies that includes a magnetometer, wireless charging system and a single-coil NFC loop.

When Apple introduced wireless charging in 2016 with the iPhone 8, the feature works great if your phone is directly aligned with the coils inside most wireless chargers. But if it's misaligned or gets bumped, the phone will charge very slowly and sometimes not at all.

The magnetometer embedded in Apple's cases for the iPhone 12 solves this problem by sensing and aligning the phone to the charging coil. This assures a consistent and rapid recharge.

Marriott Bonvoy - What they have done to attract $$ in?

As we know, tourism is the worst hit industry from this COVID19 pandemic. During the hey days, an empty hotel room will cost >RM400 at city centre or even more if it's rated 5-star and above.

Hotels these days have very few visitors and holiday makers (due to government's MCOs restrictions). Yes it's the right choice for a responsible government to do in order to minimize the risk of transmission and not to overload the medical system.

Marriott being one of the largest group in the world has allowed those hotels to subscribe to them to drop prices to pull in value holiday makers and fill up their rooms. I have stayed at the Majestic Hotel, Aloft Hotel KL and The Element KL couple of times due to the cheap offerings made, which in normal times I would probably not willing to fork out the amount for it.

1. Marriott now allows you to buy more points at get 60% more.

2. Extend all Free Nights till Aug 2021

3. They are promoting the Hotels' restaurants and takeaways. I do not know whether you would like to order a takeaway or not from Le Meridien KL's Prime and eat it at home - I probably not, considering that the price that you pay supposed to come with the ambience, service and the setting of the place. Else, it probably shouldn't be worth that price.

To find out more about Marriott Membership programme, you may refer to my previous post

*Note: I am not sponsored by Marriott Bonvoy in any manner and whatever I wrote here is based on my own experience with the membership programme.

Ever Wonder how many parking lots available in Midvalley/The Gardens?

Starbucks Malaysia Promo - 2020

How will COVID19 Ends?

The biggest question is now in everyone's mind - Will COVID19 ever end?

A fair answer to it will be - No! It will not really end but it'll evolved into something like H1N1 (hopefully!) and we can all go out again, safely!

The below are very likely scenarios that will happen over the next few years:

1. COVID19 will continue to mutate and evolve into a much more weakened virus (think H1N1 that was a real killer with morbidity rate of >10%). It currently has 1-2% mortality date and hopefully this number will drop further more. Viruses typically wants to 'live' forever, and it's the instinct of living things for their 'continuity on earth'

2. A series of vaccine that is successful in wiping out the COVID19 threat, where >70% of the human population is immunized against COVID19 hence achieving Herd Immunity. Think about this, you can still contract the virus but your body already know how to 'fight it off' without any further medication. There will definitely be some amount of population who will continue to be susceptible to the illness that is brought about by COVID19 virus. Hopefully the amount will be small and fatality rate will be very very low.

3. Effective treatment plan - this will ensure that if anyone of us is 'unlucky' and caught the virus, we have a cure to it. This is similar to having 'Penicillin' which during the WW2 managed to treat a lot of infections. Without Penicillin antibiotics millions will be dead and I am probably one of the candidate who ends up early at the graveyard considering my childhood episodes with asthma and lungs infections triggered by allergies. Read: AstraZeneca's COVID cocktail. Donald Trump had contracted COVID and had some worrying symptoms but he was saved due to the cocktail treatment. If you're wondering what is a cocktail, it is simply a mixture of different drugs or even antibodies from recovered patients, all working together to reduce human body's over-reaction to COVID19 infections and in the mean time fight against them.

Am I optimistic that either one of these above will materialize? I would say the reality might be a combination of 3 above scenarios. But the upside to mankind is that we will take a better care of ourselves, for example more hand washing, mask wearing and more sanitization of common areas.

Find us at i3investor portal as well

Ghost Knocking on Door? You'll be surprised

It has been widely circulated that there is a lady in Selangor being 'harassed' by people knocking the door at night. The more troubling thing is no one was there.

After some time, it is found that it's actually done by a cat. Watch the video to find out more.

Or watch it directly from Kak Ina's FB's page here

Review: Pizza and Coffee Co @ IJN

IJN (Institute Jantung Negara or also known as National Heart Institute) is one of Malaysia's premier heart centre. Located along Jalan Tun Razak, it is focused on treating heart related disease. Like any other modern hospitals, retail component is an important for patients and visitors as everyone needs food, a cup of hot drinks during their visit right?

Pizza and Co is located near the main entrance. When you walk in from the Main Lobby, it's on the right hand side of you.Unboxing of Amazfit BIP U

Amazfit has recently launched a new BIP watch to replace the aging Amazfit BIP Lite and BIP. I am one of the early adopters who went and bought one. It's currently on my wrist and I must say I am pretty happy with my purchase. The only big difference from my Amazfit BIP (old watch) is that it's no longer has the "always on" display.

Featured

A glimpse of how 'full' COVID19 vaccination will be..

After a year-ish of Coronavirus outbreak, we all know that COVID19 will not end or disappear, but it'll be just like other diseases (thi...

-

My thoughts after watching Bloomberg's interview with Grantham. 1. He is very thoughtful, straight-forward and managed to summarize wh...

-

The purpose of this write up is to explore options that we all have to choose where to park our money. There are a lot of schemes (or I shou...

-

One of our friends contacted us and discussed about an experience of being scammed. Nothing was lost, fortunately but all the stress and sle...