Retirement Series #2

As part of the continuation of the retirement discussion topic, we will explore how this interesting concept will allow us to retire with just RM2mil of Cash and almost never run out of them.

The rules, objective and assumptions are as below:

1. The objective is to never run out of money for the entire lifespan of a person & spouse.

2. Assumptions:

a. The person will need not to fund the kids' education and only need for personal and spouse's expenditure.

b. The person has RM2mil in hard cash. The cash can be invested in stocks, bonds, unit trusts, properties or even back into EPF (EPF allows self-employed to keep their money there for those <60 years old).

c. The person has fully paid for car and property he or she is living in.

So, what can be done?

Have you heard of the 4% rule? The 4% rule is a relatively popular retirement spending methodology. It simple terms, you may spend not more than 4% of your total investments (in this case it's RM2mil). 4% of RM2mil will give you RM80,000/year, which is RM6,666/month. It looks pretty decent for now but imagine the value of RM6,666/month in 20 years' time (it's probably like RM2,000 where it's barely enough for one single person's day-to-day basic expenditure). Think about graduates' pay which never really increases and you'll be in the same conundrum. Again, in simpler terms, this is not adjusted for inflation.

How do we tweak the model to make it work?

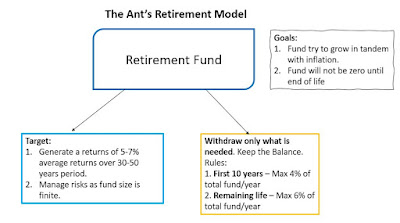

I worked on a blended model called "The Ant Retirement Model" The theory is simple, generate more than what you can spend so that you can try not to let the Retirement fund deplete.

First of all, the goals are to try to grow the fund in tandem with inflation and secondly to ensure that fund will not go into zero amount at the end of the life of the retirees.

And how do we do that?

1. Withdrawal is a very important control - for the 1st 10 years, the person is to restrict himself/herself by withdrawing <4% of the fund's value. And after that try to control withdrawal with the maximum of 6%.

2. On the returns side, set a blended portfolio which will allow an average yearly returns of between 5-7%. This has taken into consideration that Asian economies or the world economies will slow down as more countries mature.

The above diagram shows the strategy applied to generate the desired/required returns in order to fund one's retirement plan. Since the person is younger at early stage of the retirement, there will be up to 25% of the component which will be in equities to generate potentially higher returns for future use. When the person gets older, only 10% of the portfolio is being put into equities while the rest will be in Bonds, Cash funds or EPF. The reason why EPF is selected is it's a 'mixed asset fund' and it does provide the returns of 5-7% of our target above. Again, this is a hypothetical allocations which needs to be adjusted over time.

#1: Can you retire with RM3mil Net Worth?

#2: How can you retire with RM2mil cash?

#3: What is your spending power with RM6,000/month

#4: Is it possible to build a Retirement Portfolio averaging 6% return per year without EPF?

We also share our updates at i3Investor via our AntOnTheStreet Blog