In my previous articles, we mentioned about how to strategize to retire with RM 2mil cash. In the article, I did mention that while we cap our expenditure at 4% of the fund size initially, the fund need to grow 5% - 7% on average in order to be sustainable (defined as: i. Fund will almost never run dry ii. at 4% utilization, it'll be able to catch up with inflation).

How did EPF performed (historically)?

There is no magic trick or short-cut to this but I am going to simulate using Unit Trust funds due to the following assumptions and reasons:

1. The person retiring wants to enjoy retirement and not bogged down by day-to-day market swings

2. The person is not working in Financial sector nor have advance investing knowledge and skillsets. By investing all his cash (outside EPF) directly into stocks and bonds, the person takes too much of risks due to potential poor management and lack of diversification.

3. The ease of diversification via Unit Trust into World's stock markets, bonds etc.

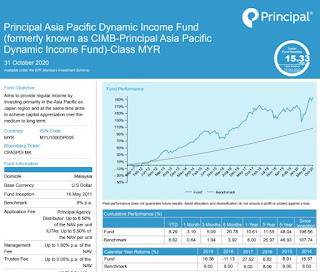

Having investing in the stock markets and other financial instruments for the past 13 years, I will use examples of Affin Hwang Select Bond Fund, Quantum Funds, Principal Asia Pacific Dynamic Income & Growth Funds, Principal Small Cap Opportunities etc to simulate them. This is not because other funds are inferior but it's due to my preference and also familiarity with those products. I see good consistencies in the management of these funds as well although for Small Cap funds, typically the investor will need to do some switching/rebalancing due to the volatility of smaller capitalization stocks.

In this study, I used FSMOne's Fund Simulator as a tool. As Principal does not let FSM carry certain flagship funds (i.e. Asia Pacific Dynamic Income and Dynamic Growth funds), I will leave it out and mention them separately.

Simulation #1 - For the 1st 10 Years (Following Ant's Retirement Model - 50% EPF, 25% Equities, 25% Bonds)

Below are just the portion of returns Excluding EPF.

As you can see from the chart above, staying invested and with zero rebalancing (no switching) gives you an average 10 year 8.76% returns! And with the RM1mil initially invested, it'll grow into RM2.3mil. The returns exceeds our target of 5 to 7%. However, do take note that the volatility is relatively high at 10%

Simulation #2 - For the Remaining Life (Following Ant's Retirement Model - 60% EPF, 10% Equities, 30% Bonds). This greatly reduce volatility and risks.

Below again is the portion of returns Excluding EPF.

By having a more conservative approach, you can see that by investing in the right products (i.e. Affin Hwang's Select Bond Fund), you still can get a whopping 7.21% average returns over a 10 year cycle. This is better than EPF's return (however, one cannot directly compare with EPF as it's 'capital protected' and mixed asset/multi-asset fund).

We can see from the above scenarios that by setting a target of 5 - 7% for returns, it's not impossible and history has proven that it's very possible and even with the lower risk portfolio, it did went above 7%.

Now, for the younger and bolder, if you're not into stock market investing, are you able to hit >8% compounded returns yearly? Let's see the below.

Investing in Principal Asia Pacific Dynamic Growth Fund since April 2016 will gives you a return of 70% (4.5 years period)!

Investing in Principal Asia Pacific Dynamic Income since April 2011 will give you a whopping 196% returns! It will turn RM1 into RM2.96.

And for Simulator #3, by having a more aggressive portfolio, you will average a return of 9.96% over a period of 10 years.

Again, let me set the record straight, I am not promoting any companies nor funds here but they are used solely for comparison purposes and to proof that it's possible to achieve your goals with these instruments. Hence, start investing today, no matter how old or young you are.

Disclaimer: I am not representing FSMOne, Principal Asset Management, Affin Hwang Asset Management or any funds mentioned above. The facts and figures may not be 100% accurate and solely for discussion and educational purposes only.

Retirement Series:

#1: Can you retire with RM3mil Net Worth?

#2: How can you retire with RM2mil cash?

#3: What is your spending power with RM6,000/month

#4: Is it possible to build a Retirement Portfolio averaging 6% return per year without EPF?