As year end is approaching, it's time for us to look into our tax and probably make some purchases in-line with tax incentives given. Please take note that I am not a tax advisor and whatever mentioned in this blog is solely for reference. If in doubt, please talk to your tax advisors for consultation or refer to your nearest LHDN office.

What constitutes as a chargeable income?

In general, a taxpayer is required to pay tax on all kind of earnings, including incomes from:

- Business or Profession

- Employment

- Dividends (in recent years, all dividends paid from Bursa listed companies have their tax paid at company level. Recipients does not need to pay for tax again. It'll be listed as 'Tax Exempted' when you receive them)

- Interest (It can be considered as a source of income by LHDN - please refer to LHDN or tax consultant for further clarifications).

- Discounts

- Rent (landlords beware as there are some costs which is considered as deductibles while some are not)

- Royalties

- Premiums

- Pensions

- Annuities

- Others

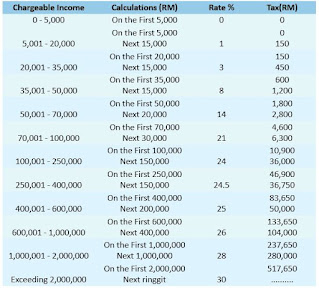

Below is the Tax Bracket on Chargeable Income (Refer Lembaga Hasil's website for further info).

Please take note that anyone earning >RM25,501 (after deducting EPF contributions) per annum in Year 2020 need to register a tax file. Refer to LHDN's note.

Tax Deductibles:

1. Individual and dependent relatives - RM9,000

2. Medical treatment, special needs and carer expenses for parents (Medical condition certified by medical practitioner) OR Parent (Restricted to 1,500 for only one mother and to 1,500 for only one father) - RM5,000 or RM3,000

3. Basic supporting equipment for disabled self, spouse, child or parent - RM6,000

4. Disabled individual - RM6,000

5. Education fees (Self) - RM7,000

-Other than a degree at masters or doctorate level - Course of study in law, accounting, islamic financing, technical, vocational, industrial, scientific or technology

-Degree at masters or doctorate level - Any course of study

6. Medical expenses for serious diseases for self, spouse or child OR Complete medical examination for self, spouse, child (Restricted to 500) - RM6,000

7. Lifestyle – Expenses for the use / benefit of self, spouse or child in respect of: - RM2,500

i. purchase of books / journals / magazines / printed newspapers / other similar publications (Not banned reading materials)

ii. purchase of personal computer, smartphone or tablet (Not for business use)

iii. purchase of sports equipment for sports activity defined under the Sports Development Act 1997 and payment of gym membership

iv. payment of monthly bill for internet subscription (Under own name)

8. Purchase of breastfeeding equipment for own use for a child aged 2 years and below (Deduction allowed once in every 2 years of assessment) - RM1,000

9. Child care fees to a registered child care centre / kindergarten for a child aged 6 years and below - RM3,000 (updated under PENJANA)

10. Net deposit in Skim Simpanan Pendidikan Nasional (Total deposit in 2019 MINUS total withdrawal in 2019) - RM8,000

11. Husband / wife / payment of alimony to former wife - RM4,000

12. Disabled husband / wife - RM3,500

13. Each unmarried child and under the age of 18 years old - RM2,000

14. Each unmarried child of 18 years and above who is receiving full-time education ("A-Level", certificate, matriculation or preparatory courses). RM2,000

15. Each unmarried child of 18 years and above that: - RM8,000

i. receiving further education in Malaysia in respect of an award of diploma or higher (excluding matriculation/ preparatory courses).

ii. receiving further education outside Malaysia in respect of an award of degree or its equivalent (including Master or Doctorate).

iii.the instruction and educational establishment shall be approved by the relevant government authority.

16. Disabled child - RM6,000 + Additional exemption of RM8,000 disable child age 18 years old and above, not married and pursuing diplomas or above qualification in Malaysia @ bachelor degree or above outside Malaysia in program and in Higher Education Institute that is accredited by related Government authorities

17. Life insurance and EPF INCLUDING not through salary deduction total RM7,000

i. Pensionable public servant category

ii. Life insurance premium

iii. OTHER than pensionable public servant category

iv. Life insurance premium (Restricted to RM3,000)

v. Contribution to EPF / approved scheme (Restricted to RM4,000)

18. Deferred Annuity and Private Retirement Scheme (PRS) - with effect from year assessment 2012 until year assessment 2021 - RM3,000

19. Education and medical insurance (INCLUDING not through salary deduction) - RM3,000

20. Contribution to the Social Security Organization (SOCSO) - RM250

21. PENJANA - special tax relief of up to MYR 2,500 is available to resident individuals for the purchase of a handphone, notebook, or tablet from 1 June 2020 to 31 December 2020

22. PENJANA - Travel related expenditure including: (i) accommodation expenses at premises registered with the Ministry of Tourism, Arts and Culture Malaysia; and (ii) entrance fees to tourist attractions RM1,000

Next: How to Optimize your Personal Income Tax for Year 2020