In any investments, there is always ups and downs. In fact, due to the correlation of economies, various commodities, demands etc and most importantly is human psychology, the market cycle clock sort of repeats itself over time.

We have seen a bust of the stock markets throughout the world due to the "black swan" event of Coronavirus causing major health crisis. The response to the health crisis inadvertently caused a very major economy slowdown and hence being reflected in the stock market. We, the humans responded to the health crisis by restricting people movement (interim measures) and researched for vaccines (long term solution). You can see that during the period of March till May, there were major corrections on commodities prices, property prices and stock prices. And once the vaccine news came out, the market reacted like nothing has happened and begin rebounding aggressively (bear in mind that none of any country has started massive immunization against coronavirus). However, it's always said that stock markets is trading with a 6-month forward looking.

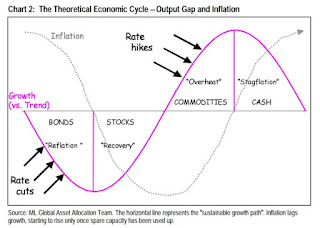

Let's have a look at the Merrill Lynch's Investment Clock below and see where are we? I remember I was looking at the same thing 10 years ago where we just emerged from the Global Financial Crisis (the crisis which started with home mortgages in the US in 2018 quickly spread throughout the world and by March 2019, most markets hit rock bottom).

|

| Merrill Lynch's investment Clock |

From the chart below, you can see those Asset and Sector Rotation over the economic cycles. The key question is where are we right now? At certain cycle, it might stay for a longer time and we might missed the opportunities by not making the right move.

|

| Asset and Sector Rotation over Economic Cycle |

|

| Theoretical Economic Cycle - Output Gap and Inflation |

The Market Cycle is very real but from what we have discussed, it's mainly for discussion and educational sake. Do use it as a guide for your investment portfolios. And a winning portfolio is normally held over time and not a short duration. Market timing remains something nobody is really able to master. For those who tried, majority has failed miserably.