According to their 2019 Annual Report, Boustead Holdings listed their subsidiaries under Page 262. There are a long list of companies and I will put down the major ones in the below table.

|

| Boustead Major Subsidiaries and Affiliates |

On 3rd Dec 2020, the closing price is RM0.625 and command a market capitalization of RM1,267mil. I compare the market cap of the 4 listed companies look at how much they are worth. If I add all the corresponding value (percentage owned by Boustead Holdings), the collective market cap is RM2,377mil and Net Tangible Asset is RM 3,760mil. One of the main reason is Affin Bank Berhad is trading at 1/3 of the NTA.

What do you get for paying RM0.625 per share for Boustead Holdings?

By paying RM0.625/share for Boustead Holdings, essentially you're also buying a portion (based on how much Boustead Holdings own) of the 4 listed companies at a steep discount (i.e. 66% discount to the NTA, 47% discount to the listed Market Cap). On top of that, you get a bunch of companies (I mean a whole bunch of them) free of charge. Is this a good value investing? It's a not a straight-forward answer but let's find out further below.

Earnings vs Value Trap

No doubt that Boustead Holdings has a long list of companies under it and also lots of valuable asset, the earnings were not so fortunate.

No doubt that Boustead Holdings has a long list of companies under it and also lots of valuable asset, the earnings were not so fortunate.

|

| Boustead Holdings: Last 5 years Quarterly Profit (after Taxation) |

As you can see, profit for Boustead Holdings has been on the downtrend for the past 2-3 years and in Q4 2019, there is a big write down. However, the losses seemed to be under control now and businesses is slowly stabilizing.

Boustead Holdings is definitely a bargain from Value Investing perspective. However, due to its sluggish earnings, it could also mean that it is a Value Trap for many. Now, let's look at who are the largest shareholders.

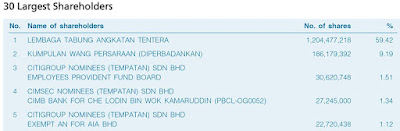

Boustead Holdings is definitely a bargain from Value Investing perspective. However, due to its sluggish earnings, it could also mean that it is a Value Trap for many. Now, let's look at who are the largest shareholders.

|

| Boustead Holdings 5 largest shareholders |

What Lies Ahead?

Recently, Boustead Holdings has announced that Dato’ Sri Mohammed Shazalli Ramly will be their new Managing Director. As you can see that Boustead Holdings is currently deemed as a 'conglomerate' and 'holding company', valuation is not exactly attractive. Also, a lot of their businesses are suffering or it's not efficient and generating good profit.

1. Potential Restructuring and Sale of Non-Core, Non-Strategic, Non-profitable Asset.

There were market talks that the majority shareholder, LTAT is looking into possibility of restructuring Boustead Holdings. There are certainly a lot of unlisted and listed assets that Boustead Holdings can look forward to monetize and pare down loans and save on interest costs. This exercise will bring value to existing investors.

2. Potential Privatization

Boustead Holding due to its very attractive and deep value is very ripe for privatization. Privatization will allow majority investor to perform restructuring easier and also unleash the value within the holding company.

3. Recovery in businesses

Businesses of Boustead Holdings are slowly recovering post MCOs.

For those investors who are patient, I believe that this could mean a meaningful bet.